Cyber attacks, online fraud, service outages or a loss of connectivity can all seriously affect your ability to do business. With so many firms completely reliant on the internet and IT, business insurance has adapted to cover these risks

Here’s a quick look at how IT insurance can protect your business.

Systems disruption

If an interruption to your IT systems would prevent your business operating and cause you to lose money, consider taking out insurance to cover this scenario.

Your existing insurance may cover you for external disruption. If your phone, internet connection or power fails for more than 24 hours, for instance, then you might be able to claim on your business insurance.

Check your policy wording carefully - many exclude internet connections, telecommunications problems and failure of utility services.

If in doubt, ask your insurance provider or broker for advice. You may be able to purchase extra cover if necessary.

Cyber and data threats

Many organisations do business solely online. Without the internet, their day-to-day work would be impossible. As well as this, an online security breach that compromises customer data could lead to liabilities under the General Data Protection Regulation (GDPR).

Most business insurance policies do not cover online security breaches and data hacks as standard. However, you may be able to get additional cover to make sure you’re financially protected. Insurers often refer to this as cyber insurance or data risks insurance.

This cover can protect your online liabilities as well as any losses you suffer due to someone else’s actions. For example, claims could be brought against your business for infringement of intellectual property rights, breach of privacy or the negligent transmission of a computer virus.

It’s worth getting insurance for these items because the cost of a claim could be crippling. However, if you knowingly flout rules and regulations, it’s highly unlikely that your insurance policy will pay out.

The volume, nature and seriousness of cyber crimes are rapidly changing, so always check exactly what you’re covered for and shop around at renewal time. You might need a specialist policy if you rely heavily on online systems. Again, consult your insurance provider or broker.

Professional indemnity insurance

Professional indemnity insurance will protect you in the event of a claim of professional negligence against you. In some cases, this could include the loss of confidential data and other breaches of confidentiality.

For example, a client could sue you if you accidentally released confidential data about them online, and this damaged their reputation. Professional indemnity insurance would cover you in this situation.

If you have a professional indemnity policy already, check to see exactly what it covers. Does it include online negligence?

Remember that if you handle data for clients, you should take every possible step to protect this information. Your contract may require you to do specific things to protect data disclosure, in addition to your responsibilities under GDPR - so make sure you’re aware of these.

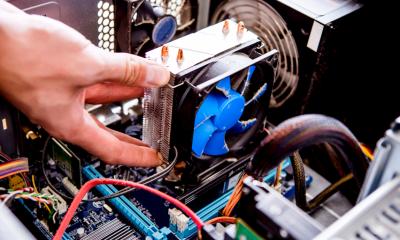

Securing your systems

No matter what IT insurance you take out, it will probably require you to maintain and upgrade your security software on a regular basis. Always have adequate, up-to-date security software in place.

Finally, make sure you meet all the conditions of your policy. If you don’t, your insurer might not pay out in the event of a claim.